gagarinblago.ru Market

Market

Dependent Tax Bracket

Exemptions ; Head of Family, $ 8, (with at least 1 dependent) ; Single, $ 6, ; Dependent, other than self or spouse**, $ 1, ; Taxpayer over 65, $ 1, For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Estimate your taxable income (for taxes filed in ) with our tax bracket calculator. Want to estimate your tax refund? Use our Tax Calculator. Income Schedule separates New Mexico income so tax liabilities can be distributed appropriately. You are not eligible to be claimed as a dependent of another. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $ Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Use this calculator to estimate your marginal tax rate for the tax year. Plus, easily calculate your income tax rate and tax bracket based on your income. It further provides for minimum personal exemptions of $1, for single taxpayers, $3, for joint filers; and a minimum dependent exemption of $ for each. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries ; Taxable Net Income, Maryland Tax ; $0 - $1,, %. Exemptions ; Head of Family, $ 8, (with at least 1 dependent) ; Single, $ 6, ; Dependent, other than self or spouse**, $ 1, ; Taxpayer over 65, $ 1, For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. Estimate your taxable income (for taxes filed in ) with our tax bracket calculator. Want to estimate your tax refund? Use our Tax Calculator. Income Schedule separates New Mexico income so tax liabilities can be distributed appropriately. You are not eligible to be claimed as a dependent of another. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $ Historical Tax Tables may be found within the Individual Income Tax Booklets. Note: The tax table is not exact and may cause the amounts on the return to be. Use this calculator to estimate your marginal tax rate for the tax year. Plus, easily calculate your income tax rate and tax bracket based on your income. It further provides for minimum personal exemptions of $1, for single taxpayers, $3, for joint filers; and a minimum dependent exemption of $ for each. Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries ; Taxable Net Income, Maryland Tax ; $0 - $1,, %.

Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana. Tax Brackets and Rates by Filing Status. Calculate Your Income Tax Brackets and Rates for , , and here on gagarinblago.ru Any additional earnings above $2, are taxed at the child's parents' marginal tax rate. For this year, a child's standard deduction amount is the greater of. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. This person is in the 15% tax bracket and so if taxed on the allowances would pay another $2, in taxes. But, in order to take home $41, after tax. revenue notice is received, the modified individual income tax bracket with the following: Removes the Dependent Tax Credit increase. Removes the. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 12%, $11, to $44,, $22, to. Tax Rate Changes – Indexed for Inflation ; If the Missouri taxable income is The tax is ; $0 to $1,, $0 ; Over $1, but not over $2,, % of excess. Use the 'Filing Status and Federal Income Tax Rates on Taxable Income' table to assist you in estimating your Federal tax rate. «Swipe for More». Filing. Marginal tax rate: Your tax bracket explained ; $95,, 22% ; $,, 24% ; $,, 32% ; $,, 35% ; $,+, 37%. Federal income tax rates ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to $, ; 32%, $, to $,, $, to. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In , there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status. For taxpayers with filing statuses of Single, Married Filing Separately, or Dependent, the local tax rates are as follows of Maryland taxable income of. Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, Pennsylvania personal income tax is levied at the rate of percent against taxable income Child and Dependent Care Credit · Unpaid Court Obligations. REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. tax brackets based on a taxpayer's filing status and type of income. Dependent child's income included in the taxpayer's federal adjusted gross income.

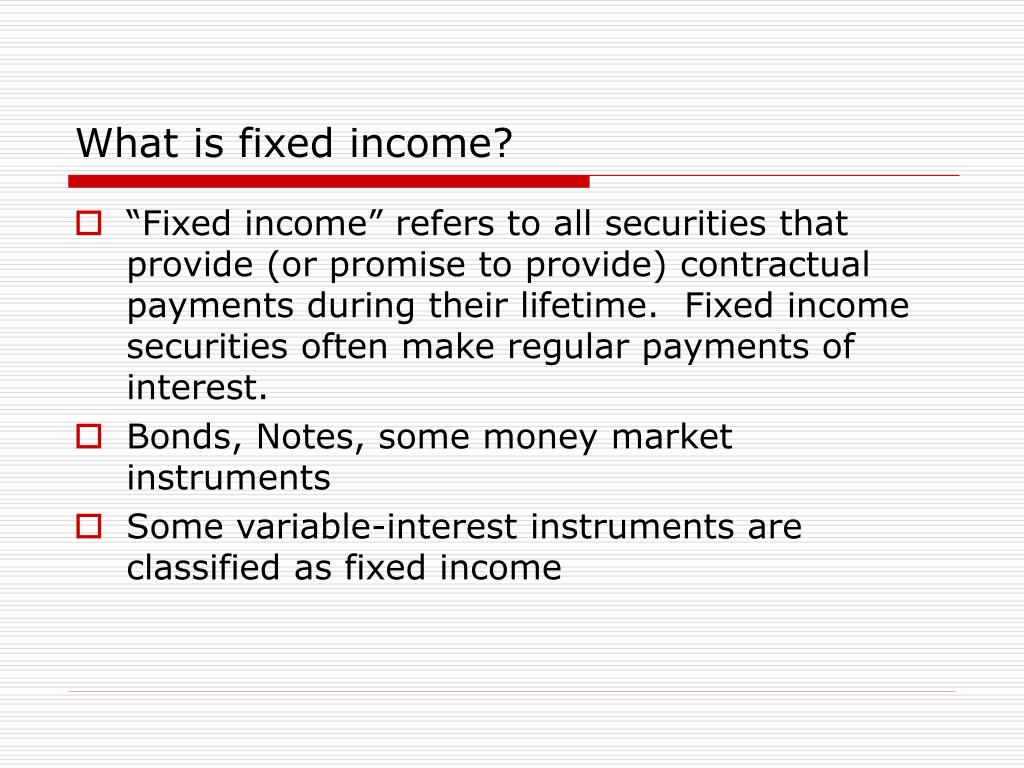

How Does Fixed Income Work

How fixed-income investments work Fixed-income investments such as bonds, are securities where you lend money in exchange for regular interest payments and. Fixed income investments · Tax-exempt and taxable municipal securities · Mortgage-backed securities (MBS) · Collateralized mortgage obligations (CMOs) · Asset-. Fixed income is held for the steady income stream the regular coupon payments provide. Bonds can offer diversification benefits because they often perform in. Here we discuss why this may be an ideal time for investors to embrace fixed-income investing as part of their diversified portfolios. The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions. Whether the fund's mandate is broad or narrow, a fixed income fund typically invests in many different securities – often buying and selling according to market. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. How bonds. Fixed-income trading is the process of trading fixed-income securities over-the-counter (OTC). The fixed-income market offers low transaction costs, a. It pays investors fixed interest payments over a specified term, plus repayment of the principal amount at maturity. For instance, a bond that pays you a %. How fixed-income investments work Fixed-income investments such as bonds, are securities where you lend money in exchange for regular interest payments and. Fixed income investments · Tax-exempt and taxable municipal securities · Mortgage-backed securities (MBS) · Collateralized mortgage obligations (CMOs) · Asset-. Fixed income is held for the steady income stream the regular coupon payments provide. Bonds can offer diversification benefits because they often perform in. Here we discuss why this may be an ideal time for investors to embrace fixed-income investing as part of their diversified portfolios. The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions. Whether the fund's mandate is broad or narrow, a fixed income fund typically invests in many different securities – often buying and selling according to market. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. How bonds. Fixed-income trading is the process of trading fixed-income securities over-the-counter (OTC). The fixed-income market offers low transaction costs, a. It pays investors fixed interest payments over a specified term, plus repayment of the principal amount at maturity. For instance, a bond that pays you a %.

They provide investors a return in the form of fixed periodic payments and the eventual return of principal at maturity. Examples of fixed-income securities. In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. Fixed income investments · Tax-exempt and taxable municipal securities · Mortgage-backed securities (MBS) · Collateralized mortgage obligations (CMOs) · Asset-. Fixed income trading involves the buying and selling of fixed income securities by fixed income investors. Fixed income securities include bonds such as. A fixed income is a type of investment security that provides investors a regular and steady stream of income. It's calculated by making worst-case scenario assumptions on the issue by calculating the returns that would be received if provisions, including prepayment. Fixed Income. City Property And Construction As Riksbank Raises Swedish ANZ CEO Tells Parliament More Work To Do Amid Trading Scandals · Australia. But when you buy fixed income, you are lending your money to the issuer. Essentially, a fixed income product is like an IOU given by the issuer to investors. The price of a bond depends on how much investors value the income the bond provides. Most bonds pay a fixed income that doesn't change. When the prices of. Zero Coupon Bonds. These bonds are issued at deep discounts and do not make any interest payments during the life of the bond. Instead, interest is compounded. Our traders and sales team can help you identify client opportunities and dig into the details of how bond ETFs work. You can also monitor the ETF market with. Choose your investor type and discover how to make fixed income investment work for you. Institutional Investor. I invest or consult on behalf of pension. How fixed-income investments work Fixed-income investments such as bonds, are securities where you lend money in exchange for regular interest payments and. The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions. Fixed income securities provide investors a stream of fixed or variable periodic interest payments and the eventual return of principal upon maturity. How Does Fixed Income Work? The term fixed income refers to the interest payments that an investor receives, which are based on the creditworthiness of the. Fixed-income instruments include a broad range of publicly traded securities (such as commercial paper, notes, and bonds traded through exchanges as well as OTC). Fixed income is not historically a source of long-term growth—it just about allows an investor to keep up with inflation, which is still running higher than the. How the power of Fixed Income investments works within your portfolio · Taxable: Short, Intermediate, Aggregate Bond, Corporate Laddered · Tax-exempt: Short. Bond investments provide steady streams of income from interest payments prior to maturity. The interest from municipal bonds generally is exempt from federal.

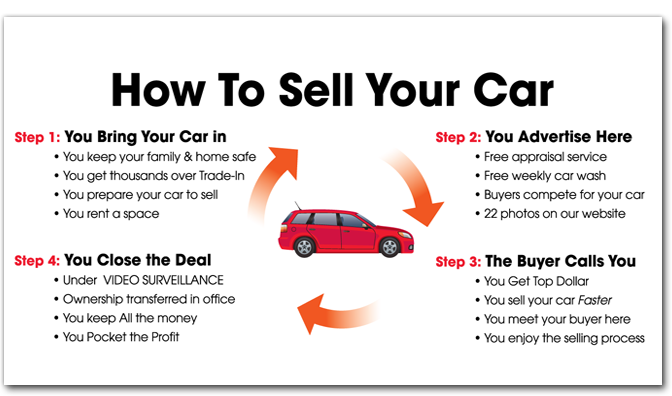

How To Sell A Used Car Yourself

Regardless if your car is an exotic, an everyday driver or a junker, there are seven documents you'll need to sell your used car privately: Vehicle History. Tips for selling a vehicle · Remove license plates · Do a vehicle inspection · Locate the vehicle's title · Complete a bill of sale · Collect payment and sign over. Selling your car privately involves determining a fair asking price, preparing your car, and taking safety precautions when advertising, meeting, and dealing. If you're going to allow a potential buyer to test-drive the car, make sure you have a way to make a photocopy of the person's driver license that has their. Selling a car yourself, however, allows you to get its full value. This method requires not only that you determine your car's real value, but also that you. 1. Decide Where To Sell Your Car · 2. Preparing Your Car For The Sale · 3. Run A CARFAX Vehicle History Report · 4. Set The Right Price · 5. Get A Copy Of Your. If you're looking to get a better price for your used car, consider having it detailed – vacuuming, upholstery cleaning, waxing, the works – before you list the. Sell it yourself and keep the difference that the dealer would have paid you plus the profit they collected from the sale of your car. Selling. Your name as seller · the name of the person buying the car · the car's Vehicle Identification Number (VIN) · the license plate number · how much you're selling the. Regardless if your car is an exotic, an everyday driver or a junker, there are seven documents you'll need to sell your used car privately: Vehicle History. Tips for selling a vehicle · Remove license plates · Do a vehicle inspection · Locate the vehicle's title · Complete a bill of sale · Collect payment and sign over. Selling your car privately involves determining a fair asking price, preparing your car, and taking safety precautions when advertising, meeting, and dealing. If you're going to allow a potential buyer to test-drive the car, make sure you have a way to make a photocopy of the person's driver license that has their. Selling a car yourself, however, allows you to get its full value. This method requires not only that you determine your car's real value, but also that you. 1. Decide Where To Sell Your Car · 2. Preparing Your Car For The Sale · 3. Run A CARFAX Vehicle History Report · 4. Set The Right Price · 5. Get A Copy Of Your. If you're looking to get a better price for your used car, consider having it detailed – vacuuming, upholstery cleaning, waxing, the works – before you list the. Sell it yourself and keep the difference that the dealer would have paid you plus the profit they collected from the sale of your car. Selling. Your name as seller · the name of the person buying the car · the car's Vehicle Identification Number (VIN) · the license plate number · how much you're selling the.

Finance contract lease agreement. If you're purchasing a used vehicle, the dealer must show you the previous owner's title. Examine the title carefully. The. The steps and process for selling a vehicle online are different in every state. Learn how to sell your used car or truck privately in Pennsylvania. You can simply take your used car to a local dealership and trade it in. The upside – this is the easiest route. The downside – dealer trade-in value is likely. If you need to sell your vehicle fast, then selling to a new or used car dealer is by far your best bet. Some franchise dealerships will write you a check on. Payment should be made in cash, or certified payment of some form. You will make an extra $2k by selling it yourself. Due to the inventory. Research new and used cars including car prices, view incentives and dealer Sell Car. License Plate VIN Year/Make/Model. Edmunds Tip. By entering your. The three largest automotive marketplaces are CarGurus, gagarinblago.ru and AutoTrader. Most of their listings are from dealers, but they do allow private party. My recommendation is to ask to take a picture of their ID and let the buyer test drive alone. I know other people will ask to hold their car. The most important thing to review and agree on is the price of the sale (documented on REG ), but it's a good idea to go over all of the documents together. If selling privately, get the word out that your car is for sale. Post online ads with detailed descriptions and photos. Also, advertise in local papers, on. 1. The Different Ways to Sell a Car When selling your car, you need to determine whether to trade in the vehicle at a dealership, sell it yourself or get a. Take the next step to get an exact, no obligation cash offer on your car from a local dealer right now, and then get paid after a quick inspection of your. Before you take any action to sell your car, you'll need to assess its value. The easiest way to find out your car's worth—without leaving home—is by using a. You'll usually get the most value if you do it yourself. Get the car super detailed so it's as nice looking as possible, get a good photographer. This can be one of the hardest parts of selling a used car. Most people don't know where to start when it comes to pricing. First, check out free appraisal. Before you even begin to think about selling your car, you need to know how much your vehicle is worth, and whether or not selling will be profitable (versus. Sell a Motor Vehicle · Gather What You'll Need. The vehicle's Certificate of Title; Proof of sale, such as a Bill of Sale (Form T-7) · Transfer Ownership of Your. Explore the best online car selling websites. List your vehicle on trusted websites to reach a wide audience and earn the most money from your used car. Before you take any action to sell your car, you'll need to assess its value. The easiest way to find out your car's worth—without leaving home—is by using a. 1) Decide How to Sell · 2) Get Ready to Sell Your Car · 3) Get Your Vehicle Ready to Sell · 4) Set the Right Price · 5) Advertise Your Used Car · 6) Safely Show Your.

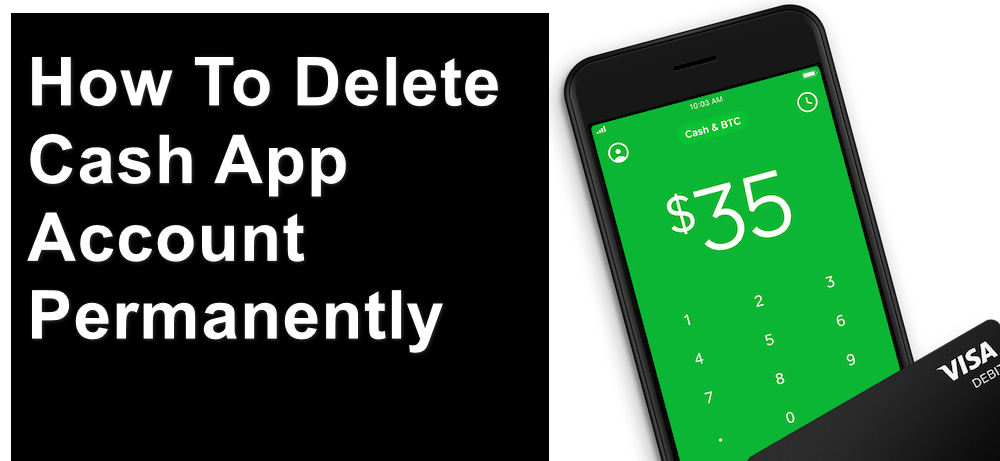

Delete Cash App Account

Go to that, your account no. will be there. Just click the delete icon in front of this and account will be removed. Deleting a Cash App account is very easy, and whether you're using Android or iPhone, you shouldn't encounter any issues with doing so. To erase your Cash App account, first transfer your funds to your bank. Then, within the app, select “Profile,” then “Support” and then “Something Else.”. ATTENTION: Only for use in participating laundry locations. Clean Cash by Caldwell & Gregory provides the easiest and smartest complete laundry solution. Sometimes, you may want to delete your account because you want to use the phone number or email address associated with it on another account. Unfortunately, Deleting Cash App card transactions is not possible because it is against the safety rule of Cash App. however, just like we mentioned earlier. Select the profile icon on your Cash App home screen · Locate and select Sign Out · Then enter the phone number or email associated with the account you wish to. Tap the profile icon on your Cash App home screen; Select Support; Navigate to your issue; Tap Contact Support. To learn more about security and best practices. Deleting a Cash App account requires one of two routes. (1) access the application through the account holder's phone to make the changes. Or (2) contact. Go to that, your account no. will be there. Just click the delete icon in front of this and account will be removed. Deleting a Cash App account is very easy, and whether you're using Android or iPhone, you shouldn't encounter any issues with doing so. To erase your Cash App account, first transfer your funds to your bank. Then, within the app, select “Profile,” then “Support” and then “Something Else.”. ATTENTION: Only for use in participating laundry locations. Clean Cash by Caldwell & Gregory provides the easiest and smartest complete laundry solution. Sometimes, you may want to delete your account because you want to use the phone number or email address associated with it on another account. Unfortunately, Deleting Cash App card transactions is not possible because it is against the safety rule of Cash App. however, just like we mentioned earlier. Select the profile icon on your Cash App home screen · Locate and select Sign Out · Then enter the phone number or email associated with the account you wish to. Tap the profile icon on your Cash App home screen; Select Support; Navigate to your issue; Tap Contact Support. To learn more about security and best practices. Deleting a Cash App account requires one of two routes. (1) access the application through the account holder's phone to make the changes. Or (2) contact.

Select Something Else > Account Settings > Close My Cash App Account. Tap Confirm.

Deleting your online presence might involve a lot of work — you might need to gather your Social Security number, driver's license, password, logins, and more. SSN Number and mailing address to verify the account. • Then request Cash App support to open the account. Send your request and clarify your position. The Cash. Do I delete Cash app account to hide transactions? Forum – Learn more on SQLServerCentral. How to Delete a Cash App Account? · 1. Open the Cash App on your phone. · 2. Tap on the profile icon > Support option. · 3. Then, tap on Support. · 4. Search for. Unfortunately, there is no way to delete Cash App's transactions history. When you tap on a payment it simply gives the payment details and says. deletion of your information or account data. The following Sections of these Cash App Terms survive and remain in effect in accordance with their terms. deletion of your information or account data. The following Sections of these Cash App Terms survive and remain in effect in accordance with their terms. From the Cash App home screen, select the profile icon. · Tap the “Support” option. · Tap “Account & Settings.” · Tap “Delete Your Personal Information.” · Scroll. Deleting a Cash App account is very easy, and whether you're using Android or iPhone, you shouldn't encounter any issues with doing so. From the Shop app, tap the Account icon. · Tap Settings > Data and privacy. · Tap Delete account > Delete account. · On the Are you sure you want to delete your. Here is a step-by-step guide on how to delete a Cash App account from someone's phone and ensure that their account is properly closed. You can delete your account on your iPhone, iPad, or computer by just logging into your account and navigating to the “Support” tab. The process isn't as complicated as it seems. Here's your step-by-step playbook to closing your Cash App account with style (no dramatics necessary!). Click to gagarinblago.ru to your gagarinblago.ru the menu section, look for any of the following: "Billing", "Subscription", "Payment", ". You can also file a dispute for the transaction with your bank if you've linked your Cash App account to a debit card or credit card. 6. Report the transaction. How can we help? Popular Topics. How Do I Access an Old Account? Where is my Withdrawal? What is a $Cashtag? How Do I Cancel a Payment? If you send the money back, it comes from your own account. The scammers then dispute the payment with their bank or credit card, essentially doubling the. If you send the money back, it comes from your own account. The scammers then dispute the payment with their bank or credit card, essentially doubling the. Hey - we understand it's important to get this resolved. To completely remove a sponsorship from an account, the account owner who approved. Back to the shoebox and keeping money in investment accounts. 3 yrs.

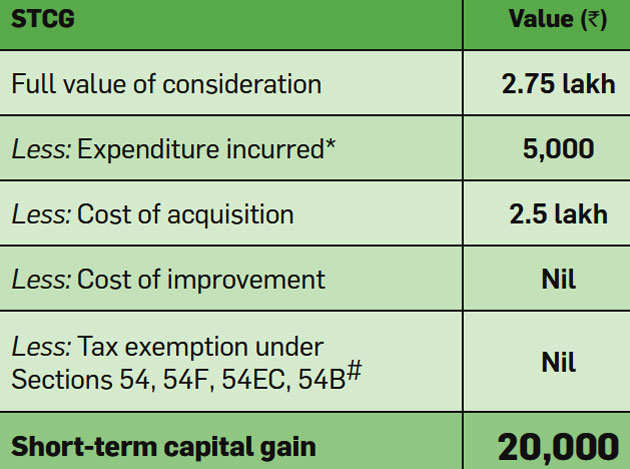

How Is Long Term Capital Gains Calculated

In this example, you pay $1, in capital gains tax ($10, x 15% = $1,). That amount is in addition to the tax on your ordinary income. Are there. Long-Term Capital Gain on Shares = Sale value of long-term equity assets – (the cost of acquisition of asset + expenses incurred due to their transfer or sale). Based on the holding term and the taxpayer's income level, the tax is computed using the difference between the asset's sale price and its acquisition price. This is typically the price of the capital asset plus improvements, minus any depreciation taken during the time the asset was owned. This adjusted basis is. Just like income tax, you'll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15, would pay. Short-term capital gain= (full value consideration) - (cost of acquisition + cost of improvement + cost of transfer). How is Long-term Capital Gain Calculated? Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per. Next, evaluate the capital gains tax on the remaining amount. For example, if your long-term gains are $1,, and your short-term losses are -$, you should. In this example, you pay $1, in capital gains tax ($10, x 15% = $1,). That amount is in addition to the tax on your ordinary income. Are there. Long-Term Capital Gain on Shares = Sale value of long-term equity assets – (the cost of acquisition of asset + expenses incurred due to their transfer or sale). Based on the holding term and the taxpayer's income level, the tax is computed using the difference between the asset's sale price and its acquisition price. This is typically the price of the capital asset plus improvements, minus any depreciation taken during the time the asset was owned. This adjusted basis is. Just like income tax, you'll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15, would pay. Short-term capital gain= (full value consideration) - (cost of acquisition + cost of improvement + cost of transfer). How is Long-term Capital Gain Calculated? Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per. Next, evaluate the capital gains tax on the remaining amount. For example, if your long-term gains are $1,, and your short-term losses are -$, you should.

How Are Capital Gains Calculated? · Separate your short-term and long-term capital gains (because they are taxed in different ways.) · Total your short term. Depending on your income, long-term capital gains tax rates are 0 percent, 15 percent, and 20 percent. These rates tend to be significantly lower than the. Federal taxes on net long-term gains (assets held more than one year) will vary depending on your filing status and income level. Use this calculator to. The long-term capital gains or LTCG Calculator is a utility tool, which shows you the long-term capital gains and the LTCG tax liability. Gains from the sale of assets you've held for longer than a year are known as long-term capital gains, and they are typically taxed at lower rates than short-. State Capital Gains Income Tax: $0 ; Total Estimated Capital Gains Tax: $0? ; Estimated After-Tax Equity (Net Proceeds) ; Total Sales Proceeds (Including Debt). For the 20tax years, long-term capital gains taxes range from 0–20% based on your income tax bracket and filing status. The calculator on this page. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. As per the new Union Budget , the taxpayers are now liable to pay % long-term capital gains tax on all financial and non-financial assets. The rate was. Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your "basis" in the asset. Your basis. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. A capital gain or loss is the gain or loss resulting from the sale of property, such as stocks, bonds, art, stamp collections, real estate, and promissory. What you believe is a reasonable long term rate of return from a particular investment or group of investments that you are considering selling. If you expect. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. short-term losses to offset my long-term capital gains? No. Short-term losses are not included in the calculation of federal net long capital gains tax. Long-term capital gains occur when the real estate is held for more than one year. Historically, investors have received preferential tax treatment because long. These gains are taxed at the long-term capital gains tax rate, which is lower than short-term gains. Gains on long-term capital assets—those held for more than.

What Is Novavax Trading At Right Now

View Novavax, Inc. NVAX stock quote prices, financial information, real-time forecasts, and company news from CNN. It's good news for Novavax that the FDA is targeting a particular Covid strain, but Novavax stock is still to pricey to buy now. Find the latest Novavax, Inc. (NVAX) stock quote, history, news and other vital information to help you with your stock trading and investing. Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. For companies with multiple common share classes, market. Novavax, Inc. ; AM · Novavax Stock Rocketed This Year, But Challenges Persist. Is It A Buy Or A Sell? (Investor's Business Daily) ; Aug PM · Is. Based on 5 Wall Street analysts offering 12 month price targets for Novavax in the last 3 months. The average price target is $ with a high forecast of. Novavax Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Novavax Inc NVV1-FF:Frankfurt Stock Exchange · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date06/06/24 · 52 Week Low. What is Novavax, Inc. stock price today? The current price of NVAX is USD — it has increased by % in the past 24 hours. Watch Novavax, Inc. stock. View Novavax, Inc. NVAX stock quote prices, financial information, real-time forecasts, and company news from CNN. It's good news for Novavax that the FDA is targeting a particular Covid strain, but Novavax stock is still to pricey to buy now. Find the latest Novavax, Inc. (NVAX) stock quote, history, news and other vital information to help you with your stock trading and investing. Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. For companies with multiple common share classes, market. Novavax, Inc. ; AM · Novavax Stock Rocketed This Year, But Challenges Persist. Is It A Buy Or A Sell? (Investor's Business Daily) ; Aug PM · Is. Based on 5 Wall Street analysts offering 12 month price targets for Novavax in the last 3 months. The average price target is $ with a high forecast of. Novavax Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Novavax Inc NVV1-FF:Frankfurt Stock Exchange · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date06/06/24 · 52 Week Low. What is Novavax, Inc. stock price today? The current price of NVAX is USD — it has increased by % in the past 24 hours. Watch Novavax, Inc. stock.

Novavax Inc NVAX:NASDAQ ; Close. quote price arrow up + (+%) ; Volume. 9,, ; 52 week range. -

Novavax Inc is listed in the Biological Pds,ex Diagnstics sector of the NASDAQ with ticker NVAX. The last closing price for Novavax was $ Over the last. The 10 analysts offering price forecasts for Novavax have a median target of , with a high estimate of and a low estimate of NVAX support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility. Express News | JP Morgan Maintains Underweight on Novavax, Raises Price Target to $9. Benzingajust now · Novavax Analyst Ratings. Benzingajust now · Ratings. Discover real-time Novavax, Inc. Common Stock (NVAX) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. - NVAX Stock was down % · NVAX stock had a significant decrease in value today. · Second-quarter earnings were higher than last year but did not. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. The stock price of Novavax (NASDAQ: NVAX), a Covid vaccine developer, trades at $13 per share, about 96% below its peak level of $ seen in February One share of NVAX stock can currently be purchased for approximately $ Is Novavax, Inc. listed on the NASDAQ or NYSE? 5-Star Price: $ Economic Moat: None. Capital Allocation: —. News. View All · Novavax Formula COVID Vaccine Now Authorized and Recommended for. Get the latest Novavax, Inc. (NVAX) stock news and headlines to help you in your trading and investing decisions. Novavax Inc (NVAX) ; Open: ; Day's Range: ; 52 wk Range: ; Volume: 9,, ; Average Vol. (3m): 9,, According to 5 analysts, the average rating for NVAX stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. JPMorgan analyst Eric Joseph slashed his price target on Novavax by more than $, to $27 per share. For Now, Moderna Is an Options Play For Me. The shares. Stock analysis for Novavax Inc (NVAX:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Novavax Inc. ; Next Fiscal Year Estimate, ; Median PE on Next FY Estimate, N/A ; High, $ ; Median, $ ; Low, $ Novavax Inc has a consensus price target of $51 based on the ratings of 7 analysts. The high is $ issued by Cantor Fitzgerald on June 8, Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. now or see the quotes that matter to you. Novavax COVID Vaccine, Adjuvanted ( Formula) now authorized Global authorization site for Novavax COVID Vaccine (recombinant, adjuvanted). 5-Star Price: $ Economic Moat: None. Capital Allocation: —. News. View All · Novavax Formula COVID Vaccine Now Authorized and Recommended for.

How Can U Get Free Money On Cash App

As with Cash Flipping, if someone promises you free money in return for sending them a payment, it is likely a scam. Moreover, Cash App will never request funds. Yes, Cash App is among several person-to-person payment apps to which you can usually link a credit card to send money and to pay bills. First, make sure you. 1 Use a Referral Code · 2 Refer Friends · 3 Participate in Giveaways and Sweepstakes · 4 Use the CashApp Debit Card · 5 Waive ATM Fees · 6 Take Advantage of Cash. Cash App does offer a way to get some free ATM withdrawals, though. Receive qualifying deposits of $ or more in your Cash App account, and you'll be. - Complete an available offer cash app. - Launch it and start earning. - Get credits from completed offers. Get rewards! Earn up to $ per month or more! Make Money: PayPal Cash Cash App for Paid Surveys & Rewards Apps. Did you know? Fact: Work tomorrow will be totally different from work today Future today. Q: Does Cash App give away free money? A: The Cash App team holds periodic sweepstakes on our official Twitter account (gagarinblago.ru) where. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. It's free to send and receive money, stocks, or bitcoin** within Cash App. Cash App is a financial services platform, not a bank. Banking services are provided. As with Cash Flipping, if someone promises you free money in return for sending them a payment, it is likely a scam. Moreover, Cash App will never request funds. Yes, Cash App is among several person-to-person payment apps to which you can usually link a credit card to send money and to pay bills. First, make sure you. 1 Use a Referral Code · 2 Refer Friends · 3 Participate in Giveaways and Sweepstakes · 4 Use the CashApp Debit Card · 5 Waive ATM Fees · 6 Take Advantage of Cash. Cash App does offer a way to get some free ATM withdrawals, though. Receive qualifying deposits of $ or more in your Cash App account, and you'll be. - Complete an available offer cash app. - Launch it and start earning. - Get credits from completed offers. Get rewards! Earn up to $ per month or more! Make Money: PayPal Cash Cash App for Paid Surveys & Rewards Apps. Did you know? Fact: Work tomorrow will be totally different from work today Future today. Q: Does Cash App give away free money? A: The Cash App team holds periodic sweepstakes on our official Twitter account (gagarinblago.ru) where. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. It's free to send and receive money, stocks, or bitcoin** within Cash App. Cash App is a financial services platform, not a bank. Banking services are provided.

All it takes to pay someone is their phone number, email, or $cashtag. You can even scan their QR code straight from the app. Keep track of your. If there was, Cashapp would notice it and reverse any such glitch. No free lunch. They probably have you pay money to get money, then you never. You can make standard deposits from your Cash App business account to your bank account for free. If you need the money instantly, say to cover a bill, then you. 1. Refer friends to Cash App and get paid with the Cash App referral program · 2. Sign up for Cash App and get a bonus · 3. Shop and earn with Cash App Boosts · 4. No, it is not possible to obtain free money on Cash App by sending funds to yourself across various accounts on different devices. By engaging in legitimate survey opportunities and completing tasks, you have the chance to earn free Cash App money. Remember to regularly check the app for. to Pay Sign,QR Code Sign, CashApp Payment Sign, PayPal Payment Sign Cash App Rewards Free- Real cash App & CashApp Money. by Augustine Harrell. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. This will enable you to use the app and access the cash register. After you have created a cashier credential, you will start receiving free. To make payments, you need the contact's phone number, QR code, or email, and can then either send or receive money, which is free of charge. Cash App is. A: The Cash App team holds periodic sweepstakes on our official Twitter account (gagarinblago.ru) where Cash App customers can win money from Cash. You can get free money on Cash App by referring friends to join the app after you've created your account. You can earn cash for every new user who joins the. How to Get Free Money on Cash App Instantly · InboxDollars: Join & Get $5 Instantly · Rover: Try a New Dogsitter and Get $10 · Survey Junkie. 1. Choose an offer. Take your pick from the tasks on the earn page. We list the best offers from companies who want to advertise their apps, surveys, and. The Cash App Card is a free, customizable debit card that is connected to your Cash App balance. It can be used anywhere Visa is accepted, both online and in. It's % legal and it's dead simple to do. Use the Yotta debit card as the source of funds whenever you make a payment on Cash App. Cash App is using the good old virality technique to grow its user base. You get a $5 bonus per friend that joins the app on your referral. How to Start Using. Transfer up to $7, each week; · Receive unlimited transfers and direct deposits; · Buy and sell stocks; · Trade cryptocurrency; · Use a Cash App card; · Get a tax. Plus, when you deposit $ or more in paychecks, you're eligible to get up to $50 in free overdraft coverage. Easy money moves. With recurring deposits. Download the app for iPhone or Android; Create a Cash App account; Connect Cash App to your bank account; Add cash to your Cash App. When you have money in Cash.

Home Rebuilding Cost Calculator

![]()

Free rebuild cost calculator · Property type, so if it's detached, semi-detached or terraced. · Year it was built and type of construction, such as brick or. Home improvement and repair cost estimator · New Home Construction costs · Window Installation costs · Swimming Pool Installation costs · Landscaping costs. Home building insurance calculator, find out what the rebuild cost of your home will be. No registration required just calculate rebuild costs and how much. free online home replacement cost calculator. Have you ever wondered what the cost is to insure your home? Homeowners insurance protects you against financial. Looking for a home insurance calculator? These online calculators can help estimate a replacement cost for your home and contents. Replacement Cost Value vs. Actual Cash Value · Step 1: Expected lifespan of the item being replaced – current age of the item = A · Step 2: A x current. Our handy home building calculator will help you estimate the cost of rebuilding or repairing your house. rebuilding cost calculator. Use it to check that your buildings Get a rough idea of your home's rebuild cost so you don't end up paying any shortfall. MoneyGeek's home insurance calculator will give you a ballpark estimate of your cost — it's free, no personal information required, no spam. Free rebuild cost calculator · Property type, so if it's detached, semi-detached or terraced. · Year it was built and type of construction, such as brick or. Home improvement and repair cost estimator · New Home Construction costs · Window Installation costs · Swimming Pool Installation costs · Landscaping costs. Home building insurance calculator, find out what the rebuild cost of your home will be. No registration required just calculate rebuild costs and how much. free online home replacement cost calculator. Have you ever wondered what the cost is to insure your home? Homeowners insurance protects you against financial. Looking for a home insurance calculator? These online calculators can help estimate a replacement cost for your home and contents. Replacement Cost Value vs. Actual Cash Value · Step 1: Expected lifespan of the item being replaced – current age of the item = A · Step 2: A x current. Our handy home building calculator will help you estimate the cost of rebuilding or repairing your house. rebuilding cost calculator. Use it to check that your buildings Get a rough idea of your home's rebuild cost so you don't end up paying any shortfall. MoneyGeek's home insurance calculator will give you a ballpark estimate of your cost — it's free, no personal information required, no spam.

Finding the replacement cost of your home with a replacement cost calculator or other method can help ensure you're properly covered after a disaster. A simple way to estimate how much it'd cost to rebuild your home is to multiply its square footage by your area's average per-square-foot construction costs. This calculator uses our construction cost data to estimate the approximate rebuild cost of a house anywhere in the UK. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance. The Cordell Calculator is an independent online tool that helps you calculate how much it might cost to rebuild your home. HOME BUILDING CALCULATOR. Estimate the cost to rebuild. This calculator can help you work out the estimated rebuild cost of your home to help you choose your. Calculate your dream. Use our free construction calculators to estimate the cost for your next project. Please login to save your estimates. To calculate the rebuild cost of your home, you need the overall floor area, add the upstairs and downstairs floor space, then use our calculator. Your home's replacement cost estimate is a calculation of what it would cost to rebuild your home under today's market conditions. There are two ways to calculate your rebuild cost: Use the Building Costs Information Service (BCIS) calculator for guidance. Hire a chartered surveyor to. The home insurance reconstruction cost estimate is used to accurately determine the structure replacement coverage amount. It's worth evaluating how much it will cost to rebuild your home before deciding on dwelling coverage. To make an accurate estimate, it's important to consider. Use these building or contents replacement cost calculators to estimate your insurance needs. Buy online & get 30%^ off your first year of combined cover. Our cutting-edge cost-to-build-a-house calculator allows you to input factors of your dream home, creating a tailored and personalized estimate for your. Finding the replacement cost of your home with a replacement cost calculator or other method can help ensure you're properly covered after a disaster. Many insurance companies provide access to web calculators on their website. CONSUMERS. Building calculator. Estimate the cost to rebuild your house. Sum Sure . According to that calculator the cost to rebuild my home is more than its total value, including land. Solomon's policy last year, from Fireman's Fund, had a limit for the dwelling of $1,,, which was “based on an estimate of the cost to rebuild.” His new. What's on this page? · Your home's rebuild cost is the amount of money you need to rebuild it if it was destroyed by fire or flood. · Your rebuild cost needs to. A resource for professionals and homeowners to accurately estimate the Replacement Cost New of a wide variety of dwellings.

Capital One Platinum Build Credit Score

Feel free to safely and organically use % of your credit limit within a month and let whatever utilization report, provided you pay off your. The Capital One Platinum Secured Credit Card requires a low-security deposit of $49, $99 or $ (based on approval). It is a great starting point for those. When used responsibly, the no-frills Capital One Platinum Credit Card can help you build credit if you have a fair credit score or limited credit history. For consumers looking to build their credit with a no-frills credit card, the Capital One Platinum Credit Card might just be the card for you. This card doesn't. For most people, the initial credit limit may be quite low. As you use the card responsibly, you have a chance to increase your credit limit. And you won't need. If you are a new or existing cardholder with limited credit, the Capital One Platinum Credit Card is able to help you establish credit through responsible. The Capital One Platinum Card does not have a specific minimum credit score requirement, but the card was built for building credit, so applicants with limited. How to improve your credit scores · Make on-time payments every month. You can set up automatic payments or electronic reminders to help you remember due dates. The Capital One Platinum Secured Credit Card is a good option for building credit. 1: The card has a flexible security deposit, no annual fee. Feel free to safely and organically use % of your credit limit within a month and let whatever utilization report, provided you pay off your. The Capital One Platinum Secured Credit Card requires a low-security deposit of $49, $99 or $ (based on approval). It is a great starting point for those. When used responsibly, the no-frills Capital One Platinum Credit Card can help you build credit if you have a fair credit score or limited credit history. For consumers looking to build their credit with a no-frills credit card, the Capital One Platinum Credit Card might just be the card for you. This card doesn't. For most people, the initial credit limit may be quite low. As you use the card responsibly, you have a chance to increase your credit limit. And you won't need. If you are a new or existing cardholder with limited credit, the Capital One Platinum Credit Card is able to help you establish credit through responsible. The Capital One Platinum Card does not have a specific minimum credit score requirement, but the card was built for building credit, so applicants with limited. How to improve your credit scores · Make on-time payments every month. You can set up automatic payments or electronic reminders to help you remember due dates. The Capital One Platinum Secured Credit Card is a good option for building credit. 1: The card has a flexible security deposit, no annual fee.

Cardholders can build credit history with this secured credit card, but it's not the best fit for those who want to earn rewards while building credit. Credit-Building FAQs ; 1. What are the major credit bureaus? ; 2. How can I build my credit if I have no credit? ; 3. What is your credit score if you have no. The Capital One Platinum credit card is designed for people with fair credit who want to build their credit score. It doesn't earn rewards but has enough. PREMIER Bankcard® Grey Credit Card · Pre-qualify with no impact to your credit score · Helping people build credit is our first priority – start your credit-. The Capital One Platinum Card is for individuals with lackluster, but not very bad, credit scores (we recommend at least a FICO score). It can be used to. Click "Rates & Fees" to see more details · No annual or hidden fees. · Be automatically considered for a higher credit line in as little as 6 months · Help build. If you're struggling to qualify for a credit card, the Capital One Platinum Credit Card only requires a fair credit score credit card to build a credit score. Waiting 6 months is probably the better route. At the very least, you'll want to see what your credit score is before applying for more credit. The Capital One Platinum Credit Card is a practical tool for those beginning their credit journey or looking to rebuild their scores. No credit score required to apply, but may be used if available · No annual or hidden fees. · Building your credit? · Put down a refundable security deposit. 1. Understand credit-scoring factors · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured credit card · 5. Become an. No annual or hidden fees. · Be automatically considered for a higher credit line in as little as 6 months · Help build your credit through responsible use of a. According to Capital One, this card is geared to consumers with average credit or better. This typically means a FICO score of or higher. The Capital One Platinum Secured Credit Card provides an accessible option for improving your credit history with required deposits starting as low as $ If you've graduated beyond the credit-building stage, choose the Quicksilver for its handsome rewards. Updated Sep 11, a.m. PDT · 1 min read. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. Capital One reports to all three credit bureaus, so with responsible use, you should see your credit score improve. Capital One will consider you for higher. For consumers looking to build their credit with a no-frills credit card, the Capital One Platinum Credit Card might just be the card for you. This card doesn't. This card has a $0 annual fee, so it can be a good starter card. If you pay off your balances in full and on time, this card can help you build credit. Overall, the Capital One Platinum credit card is a good option for people who are looking to build or improve their credit score and don't need rewards or.

Where Can You Add Money To A Cash App Card

Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. Cash App, which is backed by the Square payment network, allows you to receive direct deposits, pay bills, and even withdraw cash or pay in-store with a linked. Some popular retailers that allow Cash App card reloads include Walmart, Walgreens, CVS, and Dollar General. Simply provide your Cash App card. Apple Vision Pro: Open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Add Money. Enter an amount. The minimum is $ Tap Add. Tap the Money tab on your Cash App home screen · Press Add money · Choose an amount · Tap Add · Use Touch ID or enter your PIN to confirm. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. It's easy. 7 11, rite aid, walmart all allow you to put cash money on your cash app account. Steps are easy. Open up the. 1. Open Cash App on your smartphone · 2. Enter the amount of money you want to send · 3. Tap “pay” on the screen · 4. Enter the recipient's name, email address, $. Launch Cash App · Tap the bank icon in the lower left corner to open the Banking tab · Tap the Add Cash button · Enter the amount of cash you want to add to Cash. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. Cash App, which is backed by the Square payment network, allows you to receive direct deposits, pay bills, and even withdraw cash or pay in-store with a linked. Some popular retailers that allow Cash App card reloads include Walmart, Walgreens, CVS, and Dollar General. Simply provide your Cash App card. Apple Vision Pro: Open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Add Money. Enter an amount. The minimum is $ Tap Add. Tap the Money tab on your Cash App home screen · Press Add money · Choose an amount · Tap Add · Use Touch ID or enter your PIN to confirm. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. It's easy. 7 11, rite aid, walmart all allow you to put cash money on your cash app account. Steps are easy. Open up the. 1. Open Cash App on your smartphone · 2. Enter the amount of money you want to send · 3. Tap “pay” on the screen · 4. Enter the recipient's name, email address, $. Launch Cash App · Tap the bank icon in the lower left corner to open the Banking tab · Tap the Add Cash button · Enter the amount of cash you want to add to Cash.

Open Cash App; Click the “Cash Card” tab; Click “Get Cash Card”; Click “Continue”; Follow the remaining steps. And finito. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. Update your Chipper Cash app to the latest version · Launch the app and log into your account · Tap on the Add Cash button on your Homepage · Claim your USD. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. Load money onto your card at Walgreens, Walmart, Dollar General, Rite Aid, 7-Eleven, or CVS (may be charged a $4 fee). Some popular retailers that allow Cash App card reloads include Walmart, Walgreens, CVS, and Dollar General. Simply provide your Cash App card. Follow these steps to send or receive money in your MAJORITY account with Cash App: The MAJORITY card is issued by Axiom Bank, N.A. Member FDIC. Open Cash App; Click the “Cash Card” tab; Click “Get Cash Card”; Click “Continue”; Follow the remaining steps. And finito. Tap the “Banking” tab on the Cash App home screen. Press “Add Cash” and choose the amount you'd like to transfer into your Cash App account. Cash App is the easy way to send, spend, save, and invest* your money card and cashapp did not refund my money. Used at McDonald's over and over and. Savings provides a separate place to store your money and save with Cash App. You can set goals and add funds to your savings balance from your Cash App. Send and spend, bank*, and buy stocks or bitcoin**. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank. Set money aside for a goal or rainy day, and watch it add up. Save Cashing Out transfers your funds from your Cash App balance to your debit card or bank. Cash App supports debit and credit cards from Visa, MastercCard, Amex, and Discover. Cash App is the easy way to send, spend, save, and invest* your money card and cashapp did not refund my money. Used at McDonald's over and over and. Open your cashapp. In the bottom left corner where it shows your balance (the spot you click to add money) tap that. Just below your balance it says more ways. The Cash App Card is a Visa debit card that you can use to pay with your Cash balance. Step 1. Locate Your Store ; Step 2. Scan Your Barcode on Your App* ; Step 3. Load Your Cash. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY.